Is America’s Economy Heading for a Consumer Crunch?

Submitted by Law Office Blogger on Thu, 06/06/2024 - 1:47pm

"Nothing has been able to stop American consumers. At first they splashed covid-19 savings on home-exercise bicycles; now they are more likely to plump for beachside holidays. Predictions made by bank bosses last summer that households would be squeezed by inflation have been confounded. Instead, their outlays have powered American gdp ever higher, at a pace beyond the country’s g7 peers.

But are the predictions at last coming true? Monthly consumer-spending growth fell from 0.7% in March to just 0.2% in April. Overall spending shrank in real terms. Retail sales have weakened, with brands from McDonald’s, a burger purveyor, to 3m, a maker of sticky tape, warning that customers are closing their wallets. The recent spending data, released on May 31st, helped wipe almost a percentage point off the prediction of annual gdp growth from the Atlanta branch of the Federal Reserve, cutting its “nowcast” for the second quarter of the year to 1.8%."

Nowhere is the pain clearer than in credit-card data. According to the San Francisco Fed, households burned through the last of their $2.1trn of pandemic-era excess savings in March. The drawdown has pushed more and more to rely on credit cards to meet their outgoings, and some are now struggling to repay debts. Paul Siegfried of TransUnion, a credit bureau, estimates that since April last year, 440,000 credit-card holders have been downgraded to subprime status. Accounts are becoming delinquent at a pace last seen in 2011. People who have taken out loans to buy cars are falling behind on repayments almost as fast, causing some to sell their vehicles. According to Kelley Blue Book, a sales platform, used-car listings were up 6% in May from a year earlier.

Florida is at the heart of the trouble. The state is home to lots of low-income workers and has the highest delinquency rates of a sample analysed by the New York Fed. Esther Lopez has worked at ace Cash Express, a payday lender in Little Havana, Miami, for 15 years. She says her store is handing out fewer loans than before covid—but only because so many competing lenders have recently opened, in anticipation of a rise in demand. The city’s residents will take longer than those anywhere else in the country to repay their credit-card debt, reckons WalletHub, a personal-finance firm. Aptly, Miami’s baseball stadium is called loanDepot Park.

Some remain bullish about America’s economy as a whole, however. Eric Wallerstein of Yardeni Research, a consultancy, sees rising delinquency rates as a return to normality, rather than a harbinger of worse to come. True, higher interest rates mean poor creditors are more likely to fall behind on repayments. And at 5.25-5.5% the Fed’s benchmark rate is more than double what it was in 2019. Yet delinquency rates are much lower than they were in 2007—the last time interest rates were this high—and indeed at any time from 1991 to 2011. Banks are relaxed about the current level of stress, and are raising credit limits faster than customers can use up their balances.

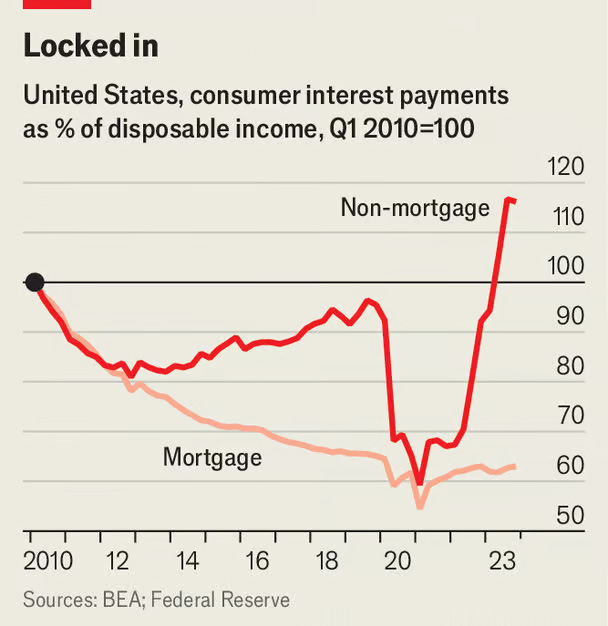

Plenty of Americans remain supremely comfortable. Big spenders on large incomes—the sort more commonly found in Miami’s South Beach than in Little Havana—can easily repay credit-card debts. Despite the rise in interest rates, overall debt-servicing costs on homes remain low, since many mortgage-holders are on long-term fixes. All told, one-third of mortgage debt was refinanced in 2020-21 as borrowers took advantage of low rates; households are spending a smaller share of income on paying down debts than at any point in the 2010s. Those who own homes and stocks are also enjoying rising asset prices and associated rental and dividend incomes. The s&p 500 index of large American companies is up by 12% this year, for instance.

What matters for the overall economy is how many consumers end up struggling to make ends meet. Rising incomes, along with pandemic savings, were what really fuelled America’s rip-roaring spending. With saving rates low and excess savings exhausted, continued spending will have to be fuelled by still-higher incomes. Employment remains strong and initial jobless claims are steady. Although in April monthly nominal wage growth crept down, recent data also suggest that inflation may have resumed its descent, which would provide a boost to real incomes. Households’ balance-sheets have weakened, but with a bit of luck America might keep dodging a consumer crunch.

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987