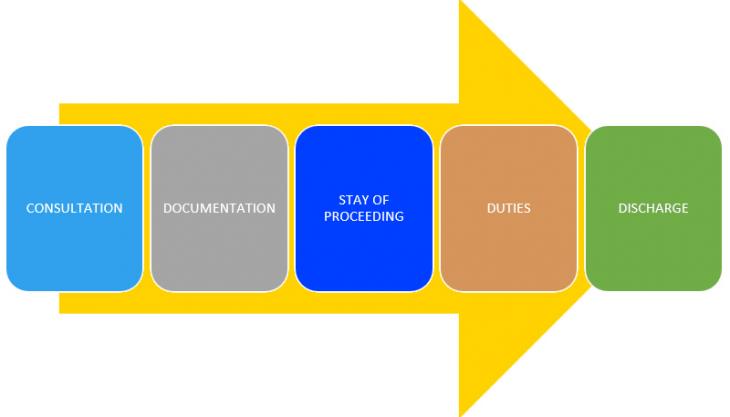

The Bankruptcy Process Step-by-Step

Submitted by Shawn Orcutt on Mon, 08/10/2020 - 12:22pm

The First (Free?) Step

It is common for Bankruptcy attorneys to offer free consultations. It might be prohibitive to have to pay a couple hundred dollars upfront to discuss a solution that may or may not be right for you. To make the most of your free time together, then some paperwork may be required before the appointment. Don’t look at the paperwork as homework. It is accelerating you closer to find out answers sooner. It is for your benefit and saving both of you time. For example, our firm has a few forms that can be filled-out online so you can take your time and do it when you are able to focus on it. Also, it can be done in the office before the appointment. Generally, you can answer everything from memory with understandable questions to help us get the big picture about what your current situation is like. House? Rent? Car? Income? Expenses? With that information you and your attorney can explore your options. Maybe bankruptcy is the best solution, maybe not. Also, there are different types of bankruptcy depending on your goals. I will write in great detail the differences between the primary ones Chapter 7 and Chapter 13. The big takeaway is that one is not better than another, they just do different things.

Follow-ups

If a filing is right for you and you wish to proceed then 2 or 3 more appointments may follow. This may be when you hire/retain the law firm to represent you. The following appointments are spread out because work is being done in between each one. You may be provided additional paperwork to get the rest of the information needed for a filing. Consider the first set of paperwork you did for the first consultation to be a rough draft of your situation and the next set of paperwork to be the final draft.

Putting it all together

Next would be a meeting to give that to your attorney and go over it some. Along with that paperwork may be things like some paystubs, tax returns, and other documents required by the Court or the Trustee, then the firm is able to start preparing your Petition (the documents to be filed with the Court).

Goodbye phone calls

Lastly, you return to review the Petition the law firm has prepared for you, you check the pages for accuracy about your situation, and sign the necessary pages. As of the past 15 years or so the Petition can be filed electronically. That means that within a matter of minutes your case can be sent to the Court and you receive a case number. This number is especially important over the next week or so because if a creditor calls you then you can tell them the case number to put them on notice of the filing. It also means they are prohibited from calling or writing to collect on the debt because when the case is filed a, “Stay” goes into place, often called the, “Automatic Stay” and it is an injunction or restraining order to prevent attempts to collect.

The Meeting

Now for the post-petition steps. For many people there might only be one more time they have to be somewhere. This would be the “341 meeting” a.k.a. “Meeting of the Creditors.” There may be no creditors there. Maybe none for you, and sometimes there haven’t been any there for anyone. The timeline here is roughly 30 days +/- 5 or so from the date of the filing. This might be in a Courtroom, but probably just at a table in the room and not in the witness stand or something. The meeting could also be in just a random meeting room somewhere near where the Court is. In attendance would at least be the Trustee, who wears a couple of hats in regard to a case. The first hat is as administrator of your case and second as the conduit/voice for the creditors as a whole. So, they are somewhere between neutral and in opposition. Your attorney will be there with you though.

Details

This meeting might only last about 5 minutes when it is your turn. Yes, it can be much longer than that if the Petition is a hot mess due to the person or the attorney not preparing it well, or if the financial situation is just really complicated with lots and lots of properties involved. The Trustee might give a speech about their role at the beginning and swear everyone in. Some Trustees swear in one person or couple at a time when it is their turn. How many people are in attendance? Roughly, everyone else who filed that Chapter of bankruptcy in your area within that 10 day period should be there. For example, a regular Chapter 7 meeting in Raleigh may be two Trustees and about 50 people. From beginning to end it might average about 3 hours. If you were first, then that might have been 20 minutes (remember, the 15 minute speech). When your questions are done you are good to go and that’s it unless the Trustee specifically asks for additional documents. These might be bank statements, Deeds, or balance sheets are examples of documents requested and sometimes the attorney already has them back at the office.

So, yes, the first step might always seem like the hardest; but it doesn’t have to be. To find out more, contact the Law Offices of John T. Orcutt. Read reviews from satisfied clients, then call +1-833-627-0115 to schedule a free student loan bankruptcy consultation at one of our locations in Raleigh, Durham, Fayetteville, Wilson, Greensboro or Wilmington.

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987