How Unemployment Can Complicate the Bankruptcy Means Test

Submitted by Rachel R on Thu, 12/05/2013 - 10:55am

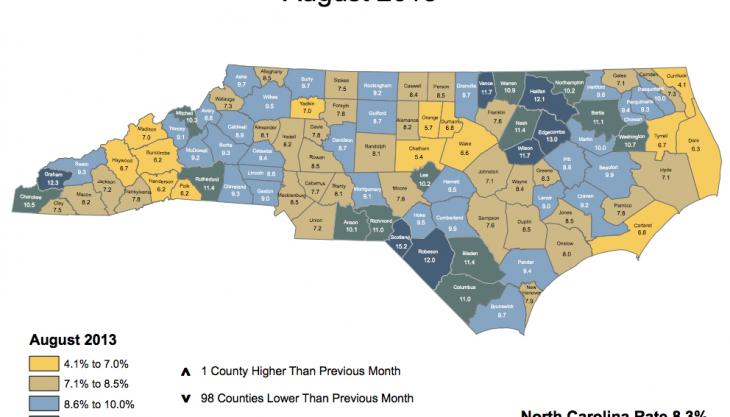

Some areas of North Carolina are experiencing very high unemployment rates.

Image source: HCPress.com

Being in an overwhelming amount of debt is difficult. Losing your job is difficult. When the two occur simultaneously, it can set off a perfect storm of financial troubles. If you’re in an area where unemployment is rampant or your field is plagued by a lack of job opportunities, you may be facing months of joblessness.

If you were already deep in debt when you lost your job, this may be the time to consider whether bankruptcy can be a viable option for you to keep your family head above water until you get another job. Filing for bankruptcy is complicated enough under any circumstances, but more so when you’ve lost a job. How so? Read on.

Means Test

The Means Test determines whether you are eligible for Chapter 7 or Chapter 13 bankruptcy protection. The finer points of the income requirements vary by state but overall, you will be judged on two main criteria. First is whether your current monthly income is at or below the average household of the same size and varies by state. You can check out North Carolina’s income limits by clicking here.

If the first criterion is met, you automatically qualify for Chapter 7 and don’t have to face the other criteria. However, if your income is more than the average household, you must show that you have very little disposable income. If it's found that you do have sufficient disposable income to pay your bills, you won't qualify for Chapter 7 which may be the best option for an unemployed debtor.

North Carolina has long had higher unemployment than the US on average.

Image source: TheBlack-eyedSusan.com

How Unemployment Can Skew the Test

Your income from the Means Test is an average of the last six months of pay. If you lost your job recently, your past wages will make it look as though you have more income than you currently do. And if you received a severance package, that could inflate the calculation even more and possibly render you ineligible for Chapter 7. But the North Carolina courts are often sympathetic to the jobless and may take this into consideration. In the case of severance, you’ll have to explain how it was spent.

Worst Case - Bankruptcy Conversion

If your Means Test was skewed by your job loss, you may be able to initially file a Chapter 13 and then convert it to Chapter 7 if your attorney can convince the court and your Trustee that you're financially eligible due to your reduced income. You may not be subject to the Means Test to convert your case. North Carolina is one of the states that treats unemployment income as exempt for bankruptcy purposes. Should you still be subjected to the Means Test, this will act in your favor.

While unemployment can complicate your bankruptcy filing, the bankruptcy court is often sympathetic to this circumstance. To find out more about bankruptcy during unemployment and whether you qualify for a Chapter 7 to help shed debt that you can’t afford now that you’re jobless, contact the law offices of John T Orcutt. We are experts in North Carolina bankruptcy and offer a no obligation free consultation to all new clients. Call now.

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987