Is the Student Loan Bubble About to Burst?

Submitted by Rachel R on Thu, 01/24/2013 - 9:35am

We’ve seen what can happen when “easy credit” policies allow bubbles to form. Eventually, the number of bad loans reaches critical mass and the bubble bursts, causing widespread economic damage. That’s what happened with the housing market and the sub-prime mortgage debacle.

The same kind of bubble effect could happen with student loan debt. There’s about a trillion dollars of it floating around out there. Movements like Occupy Wall Street and high numbers of new grads unemployed are casting a harsh light on the situation. Unlike most other debts, it’s next to impossible to have student loan debt discharged through a bankruptcy filing. If you’re facing a default on your student loans, there's no need to continue losing sleep from the stress. Here’s what you can do:

Bankruptcy. Although it’s very difficult, there are cases where you can have your student loan debt discharged through a bankruptcy filing. This isn’t going to work for most people, only for people who have very particular extenuating circumstances. Basically, you have to prove that the debt will impose undue hardship on you and your dependants.

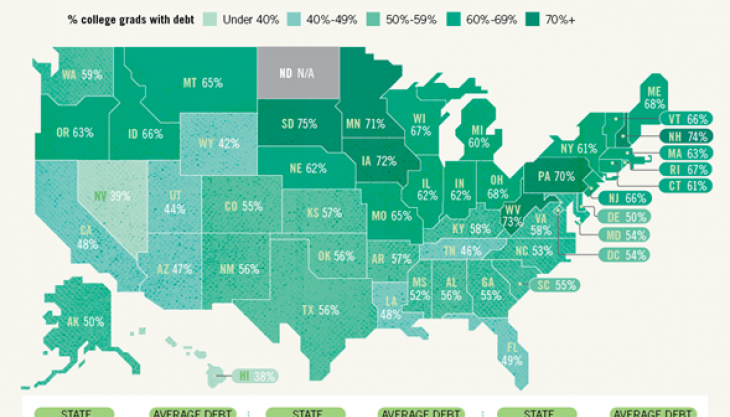

Image source: mint.com

A common standard is the Brunner test. To pass this test, three conditions must be met as follows: 1) Based on your current income and expenses, there’s no way for you to maintain a “minimal” standard of living for yourself and your family if you have to keep paying; 2) Other extenuating circumstances indicate that this situation is likely to persist for a significant portion of the debt’s payback horizon; and 3) You’ve made good faith efforts to keep up with payments.

In other words, this is really only an option for those who can’t work for some reason, such as a physical or mental disability. If this situation applies to you, what you have to do is file a separate petition called an adversary proceeding in order to trigger the determination process. If you already filed your bankruptcy case, you can re-open it to include this process, normally without having to pay any additional filing fees. Be prepared to make an appearance in court as part of the process.

Loan Cancellation/Discharge. There are also other very limited circumstances where you can have your student loans completely canceled. These limited circumstances include your school closing while you were enrolled, your school enrolling you when in fact you weren’t really qualified, your school stealing your identity, or your school not paying a refund when you left school early.

If you’ve had any of these problems with your school, visit the Student Loan Borrower Assistance website for information on applying for these cancellations. If you have become severely or permanently disabled, you may also apply for cancellation of your loan. Note that private lenders are not required to honor such practices, but some do. Visit the Disability and Death page for more information.

Deferment and Forbearance: What should you do if none of the above applies and you’re having trouble making your payments? Talk to your lender or loan servicing company right away. Your loan is delinquent if you’ve missed one or more payments. If you get to the point where you’re nine months behind, the loan will go into default status and the entire amount becomes immediately due. That nine-month window does not apply to private school loans, which will probably put you into default quicker than that.

If you’re not in default, you might be able to defer your payments for a time (1-3 years), especially if you’re unemployed, experiencing economic hardship or serving in the military. In some cases, interest continues to accrue during a deferment. A forbearance is another way to postpone payments, although interest continues to accrue, and may be granted if you are in poor health or experiencing economic hardship. You can also explore options to include your student loans in a structured debt repayment plan.

Image source: tuition.io

These are just some of the many options available to you to solve your student loan crisis. When you’re facing financial hardship, it’s important to talk to an advisor such as a qualified bankruptcy attorney to review your situation and understand the options available to you.

Dedicated to helping residents of North Carolina find the best solutions to their debt problems. Don’t waste another day worrying about your debt. Call +1-833-627-0115 today to schedule a free initial consultation to discuss your bankruptcy options.

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987