How To Get Your IRS Info: FREE "Online" Tutorial

CLIENT OPTIONS FOR OBTAINING TAX RETURN TRANSCRIPTS:

Option 1: Self-Service: (Recommended) You, the client, fill out the IRS screens, without our help, using these screens as a guide.

Cost: NO CHARGE.

Option 2: Paralegal-Assisted: One of our paralegals fills out the IRS screens for you, with you, the client, on the phone to provide the required information and to provide the required "activation code" (using your mobile phone).

Cost: $100 per client, payable in advance.

NOTE: In case of difficulties: Click here for some answers => https://www.irs.gov/individuals/get-transcript-faqs. If need be, check with your assigned paralegal.

GETTING STARTED:

Step 1:

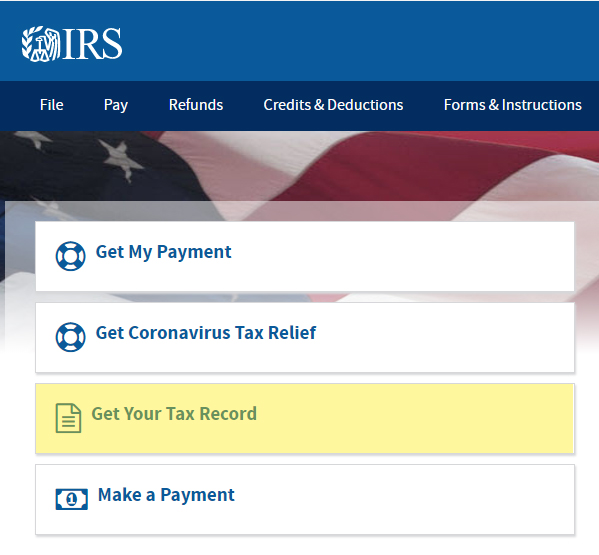

Go to irs.gov. This screen will appear.

Step 2:

Scroll down and click "GET MY TRANSCRIPT" link.

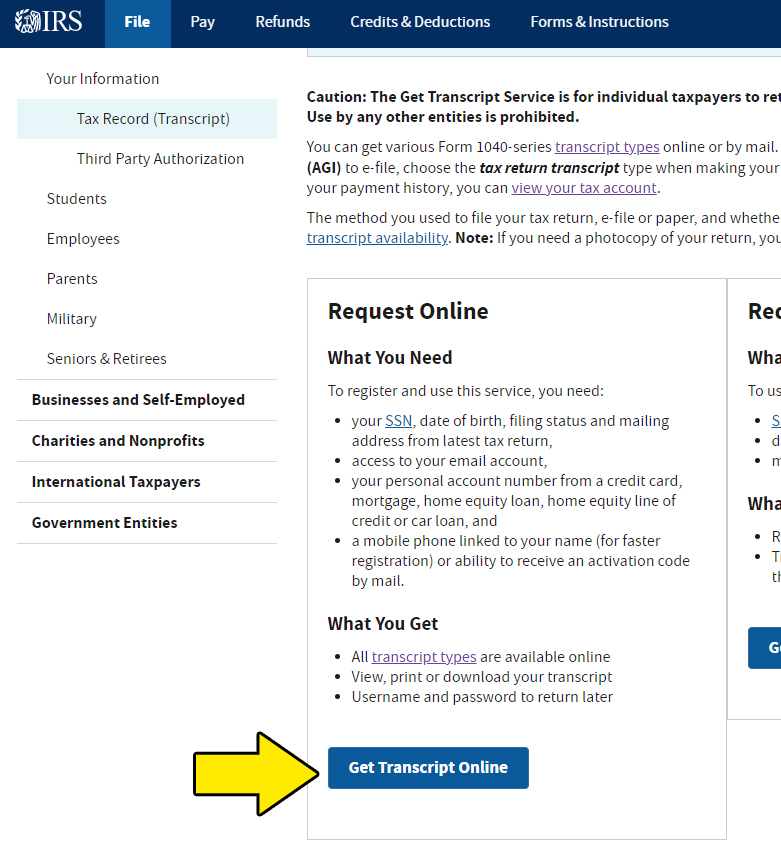

Step 3:

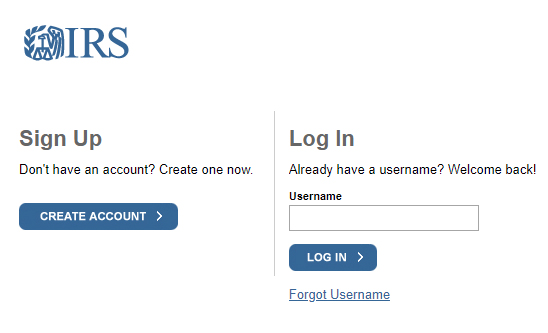

Click "Create Account" (unless you, the client, by some chance, have already created one).

If account has already been created for you or by you, find your username and password and then, just log in.

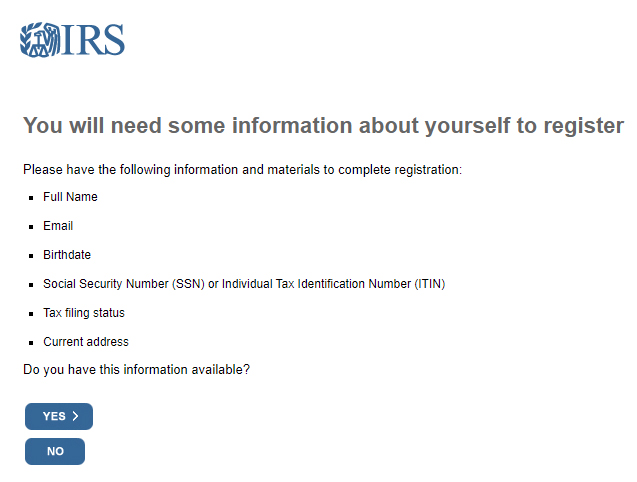

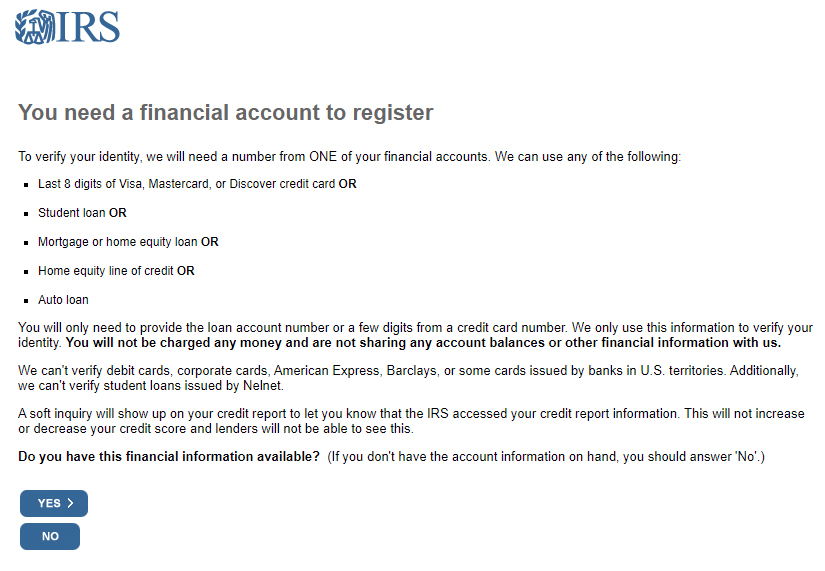

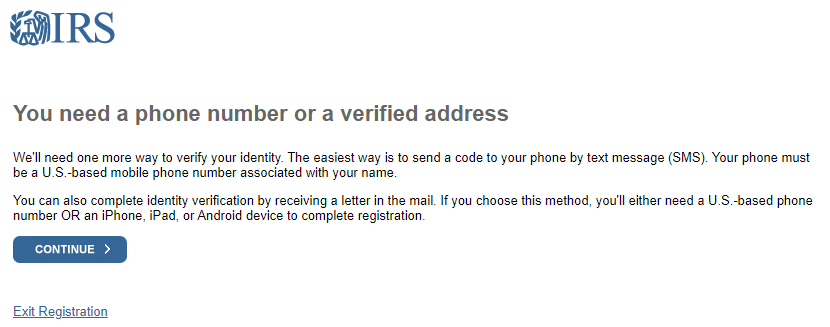

Step 4:

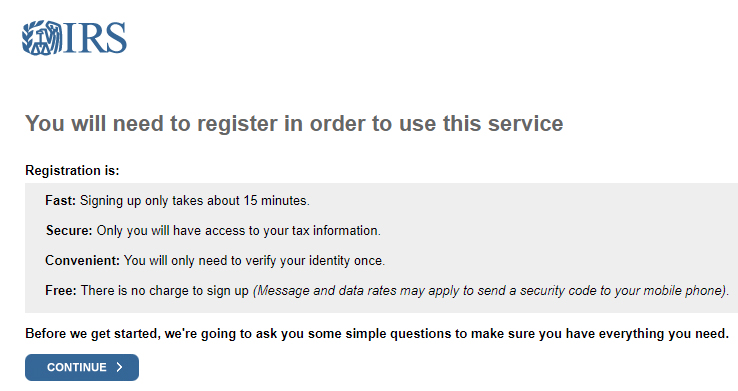

There will be 4 info-screens to click through before you can create an account. Click "continue" for each screen to proceed to the account creation screen.

info-screen 2

info-screen 3

info-screen 4

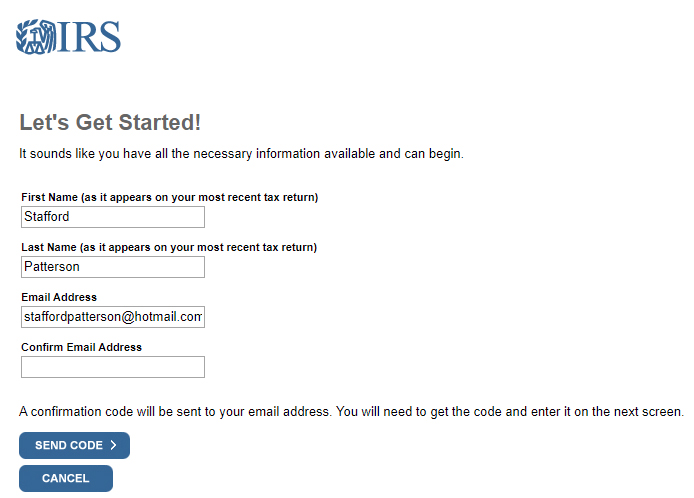

Step 5:

Fill in your information. Click "Send Code", Then, look for an email from IRS to you, which contains the required "code".

Note: This email comes in pretty quickly.

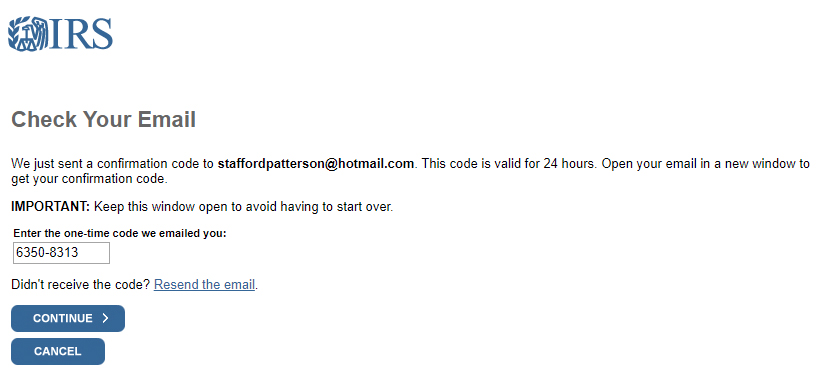

Step 6:

Input the code on this screen and then, click "continue".

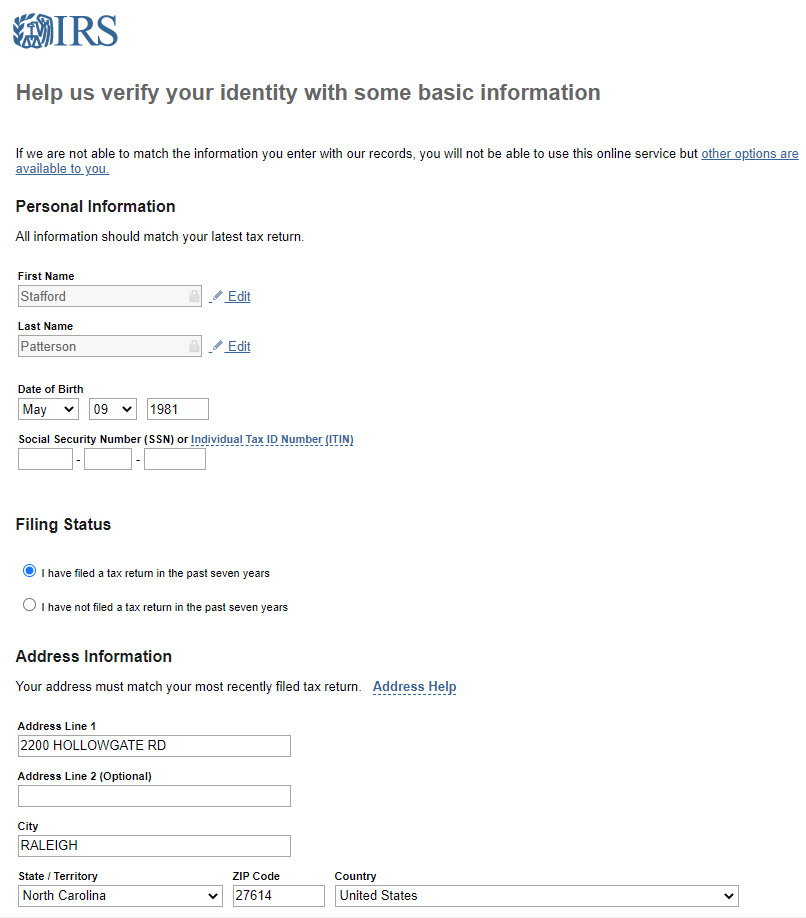

Step 7:

Fill in this information. Under filing status, select "I have filed a tax return in the past 7 years" and then click "continue".

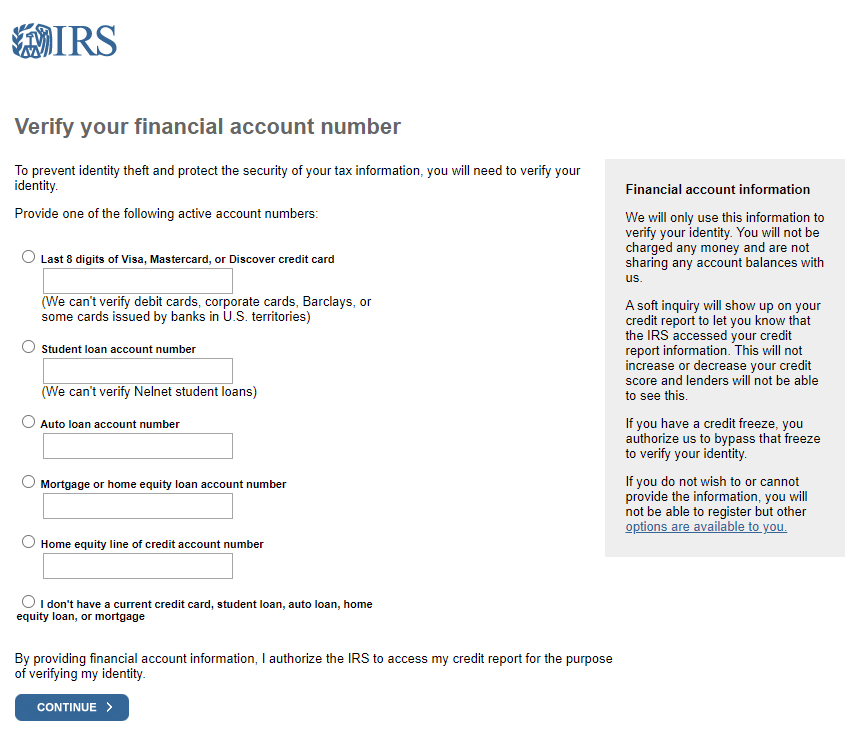

Step 8:

Input one (just one, not all) of these items to help IRS verify your identity, and then click "continue".

NOTE: You may need to try more than one to find one that works.

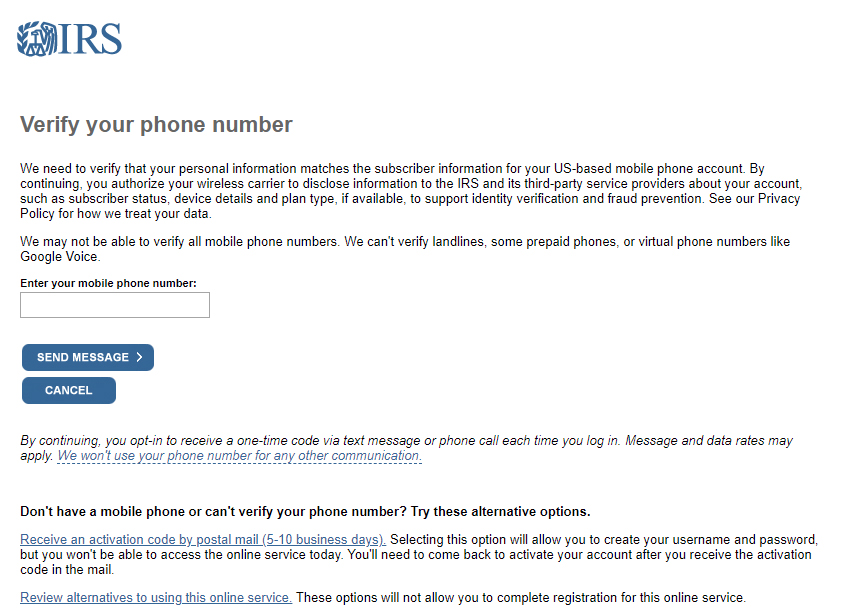

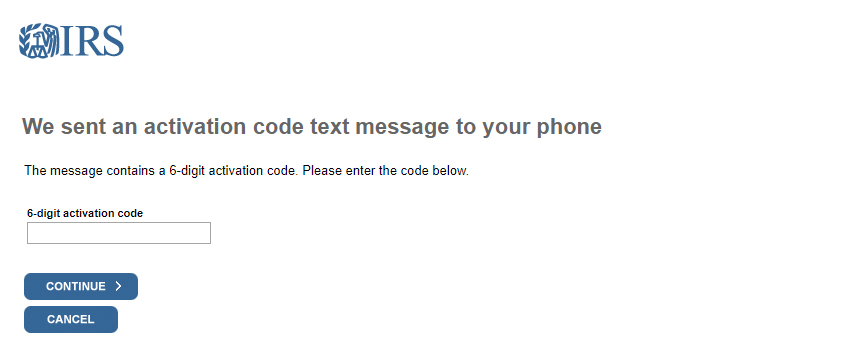

Step 9:

Input your mobile phone number and then click "send message".

NOTE: Doing so will prompt the IRS to send a text message to your mobile phone number. The text message will contain a 6 digit "activation code".

Step 10:

Input the 6 digit "activation code", and then click "continue".

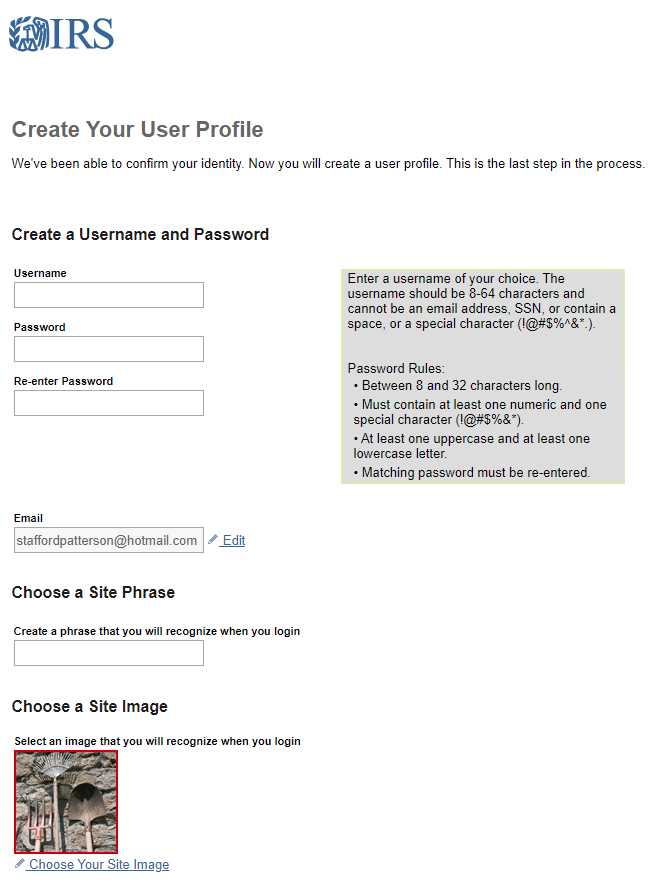

Step 11:

Create a "User Profile" for yourself and then click "continue".

NOTE: This step will only be necesary if you have not previously created an account.

NOTE: You can input whatever you want. However, for a password that works, we would suggest this format: Your middle-name, followed by "#", following by your date of birth (For example: "9750" for September 7, 1950) Example: Tyrrel#9750

NOTE: No spaces are allowed in the password.

SUPER IMPORTANT: Write down the Username and Password and keep it where it can be found in case it is needed later).

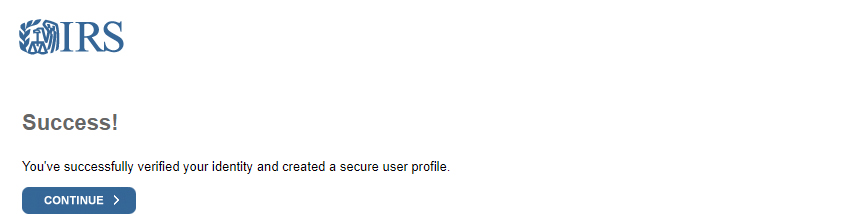

Step 12:

Click "continue".

Step 13:

Click "continue".

NOTE: All emails from IRS will likely be notitifcations that confirm the creation or access of your account.

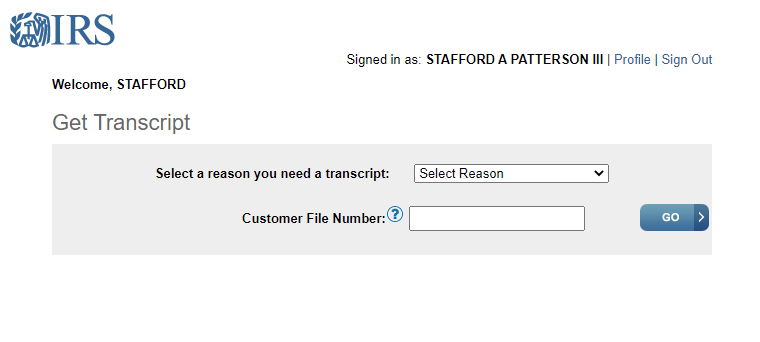

Step 14:

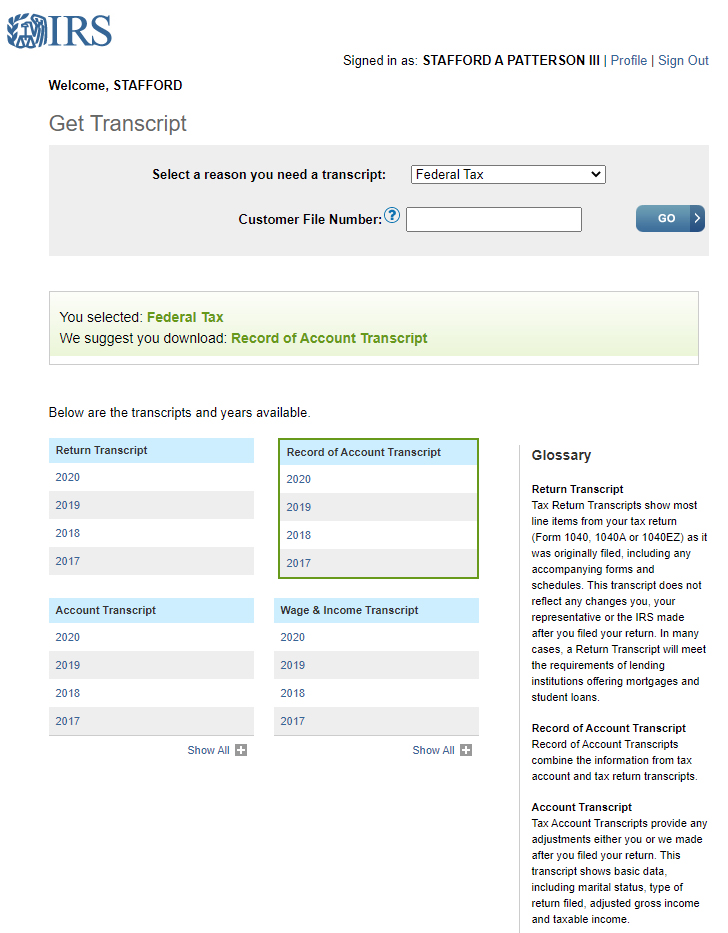

On this screen, select "Federal tax".

Leave "Customer File Number" blank.

Then, click "GO".

NOTE: Doing so will add more information to the bottom of this screen.

NOTE: Your screen should now reflect that it is you who is "signed in".

Step 15:

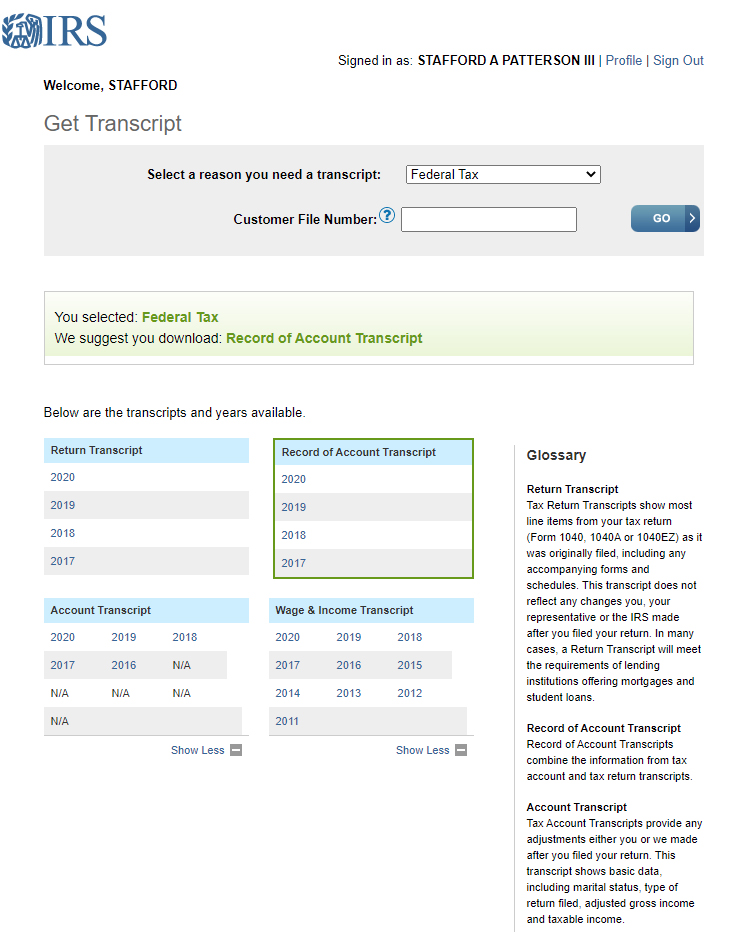

(1) Select from this screen the desired items and tax years needed for purposes of your bankruptcy case.

NOTE: For your information, before doing so, click on the 2 "Show ALL" buttons to show you all the years for which information is (supposedly) available.

NOTE: If you are not sure what is needed, stop and check with your assigned paralegal.

NOTE: In most cases, you will only need copies of your "Return Transcripts". (The equivalent to getting us copies of the client's Federal income tax returns.)

(2) Then, print out or save to your computer the documents as they appear on the screen.

(3) Repeat the process as needed until you have all the required "Return Transcripts".

NOTE: If additional documents are needed later, you will need to re-login in using the your username and password. You would also need to have your mobille phone available to receive a new "activation code".

(4) Send or give copies of these documents to your assigned paralegal.

Definitions:

"Return Transcript" is equivalent to a copy of the client's Federal Tax Return. If all our office needs is a copy of the Federal tax returns, choose years from the "Return Transcript" section.

"Account Transcript" is the IRS's analysis of the client's tax account for the year. If all our office needs is the IRS analysis (balance owing, date of assessment, etc.) for the tax year, choose years from this section.

"Record of Account Transcript" is both of them combined (Account Transcript followed directly by the Return Transcript). If we need both items for one or more tax years, choose years from this section.

"Wage and Income Transcript" shows all reported wages and income for the tax years listed. Generally, for bankruptcy filing purposes, this would not be needed, but there could be exceptions.

(Revision date: 4/1/21)

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987