File Bankruptcy to Save Your Retirement? Why It’s Actually a Smart Choice

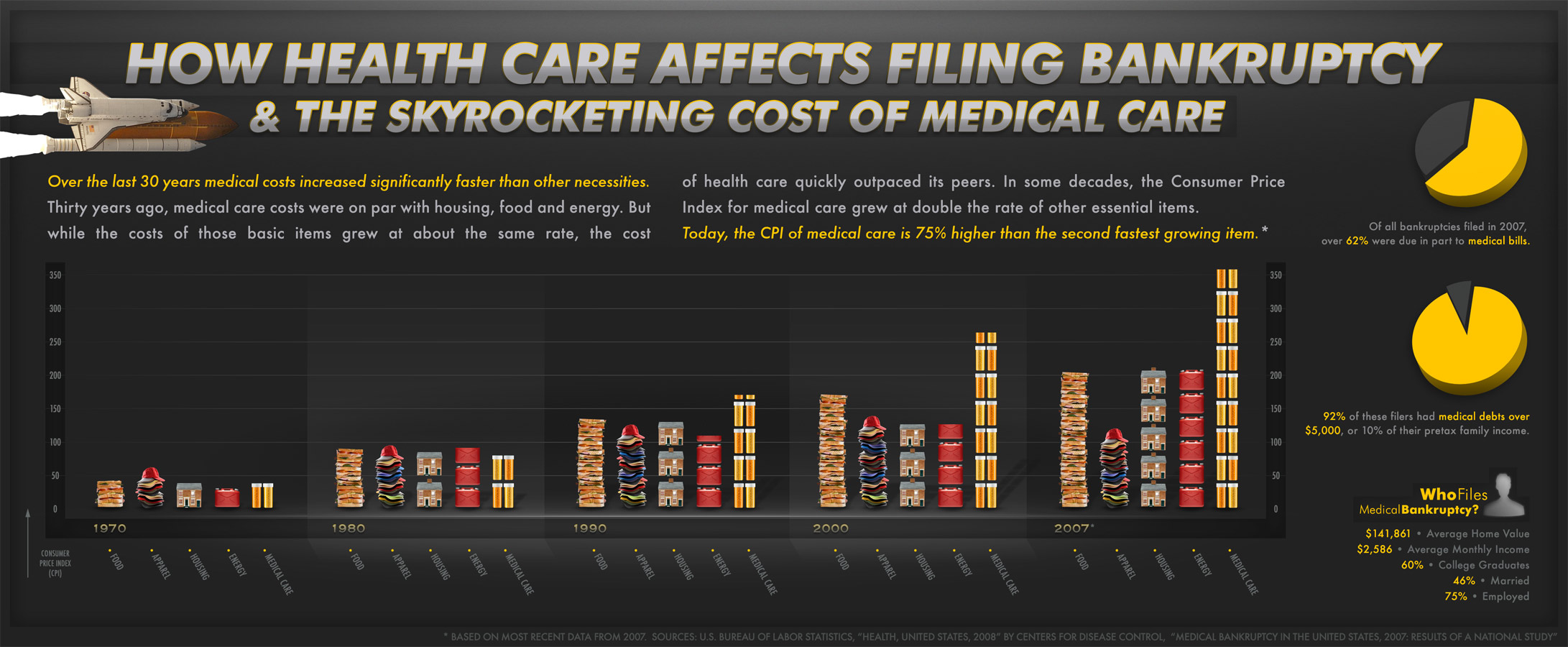

With the economy continuing its slow recovery, research data suggests that seniors are filing bankruptcy in higher numbers than ever before. According to a recent article from TheStreet.com, approximately 25.3 percent of all bankruptcies filed in 2011 involved individuals who were aged 55 or older. The cause? Living expenses, including medical expenses, are increasing while their income is decreasing. Even though government programs like Social Security and Medicare are intended to bridge the gap, seniors often find themselves coming up short and racking up debt as a result.

Stop Repossessions with Bankruptcy: How Your Vehicle Can Survive The “Repo Man”

In these difficult times, with thousands of people losing their jobs every month, it can be hard to keep up with all the expenses, especially when the bills keep coming. Falling behind on payments for a vehicle happens to the best of us. Sometimes life deals you adversity like an unexpected medical bill, a work related layoff or some other situation that no one plans for in the budget. You don’t have the money for it, but if you put off the car payment, you can get the bill paid, and hopefully can catch up on the car payment next month.

Bankruptcy Fast Facts

Bankruptcy Fast Facts